How to take advantage of CorReg ?

Clément Théry

26 avril 2017

Source:vignettes/CorReg.Rmd

CorReg.RmdCorReg’s Concept

This package was motivated by correlation issues in real datasets, in particular industrial datasets.

The main idea stands in explicit modeling of the correlations between covariates by a structure of sub-regressions (so it can model complex links, not only correlations between two variables), that simply is a system of linear regressions between the covariates. It points out redundant covariates that can be deleted in a pre-selection step to improve matrix conditioning without significant loss of information and with strong explicative potential because this pre-selection is explained by the structure of sub-regressions, itself easy to interpret. An algorithm to find the sub-regressions structure inherent to the dataset is provided, based on a full generative model and using Monte-Carlo Markov Chain (MCMC) method. This pre-treatment does not depend on a response variable and thus can be used in a more general way with any correlated datasets.

In a second part, a plug-in estimator is defined to get back the redundant covariates sequentially. Then all the covariates are used but the sequential approach acts as a protection against correlations.

This package also contains some functions to make statistics easier (see BoxPlot and recursive_tree or matplot_zone).

In this vignette we explain the main method in CorReg that leads to the correg function. This function allows to make linear regression using sub-regressions structure and/or many variable selection methods (including lasso, ridge, clere, stepwise,…)

Dataset generation

We first generate (for this tutorial) a dataset with strong correlations between the covariates. The mixture_generator function gives such a dataset and also a validation sample built with the same parameters. Both contains a response variable generated on some covariates (not all) by linear regression. So we have sub-regressions that make some variables redundent when we know the other variables. Such correlations make the variance of the regression estimators explode. Moreover, dimension is unnecessarily high and interpretation of regression coefficients is dangerous.

## CorReg: The Concept, the Method, the Power

# dataset generation

base <- mixture_generator(n = 15, p = 10, ratio = 0.4, tp1 = 1, tp2 = 1, tp3 = 1, positive = 0.5,

R2Y = 0.8, R2 = 0.9, scale = TRUE, max_compl = 3, lambda = 1)

X_appr <- base$X_appr # learning sample

Y_appr <- base$Y_appr # response variable for the learning sample

Y_test <- base$Y_test # response variable for the validation sample

X_test <- base$X_test # validation sample

TrueZ <- base$Z # True generative structure (binary adjacency matrix)We also get an adjacency matrix Z that describes the Directed Acyclic Graph of the links between the covariates. See https://en.wikipedia.org/wiki/Adjacency_matrix for more informations on adjacency matrices.

TrueZ## [,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10]

## [1,] 0 0 0 0 1 0 0 0 0 1

## [2,] 0 0 0 0 1 0 0 1 0 1

## [3,] 0 0 0 0 0 1 0 1 0 0

## [4,] 0 0 0 0 0 0 0 0 0 0

## [5,] 0 0 0 0 0 0 0 0 0 0

## [6,] 0 0 0 0 0 0 0 0 0 0

## [7,] 0 0 0 0 0 1 0 0 0 0

## [8,] 0 0 0 0 0 0 0 0 0 0

## [9,] 0 0 0 0 1 1 0 1 0 1

## [10,] 0 0 0 0 0 0 0 0 0 0

# TrueZ[i,j]==1 means that X[,j] linearly depends on X[,i]We will try to find this structure (in real life we don’t know the true structure).

CorReg’s Method

Density estimation

To find the correlation structure we need a global density model that will serve as a null hypothesis. Each variable can be independent (following a certain density we have to estimate) or can be lineary dependent on other covariates. The density_estimation function will provide this null hypothesis for each variable. We use Gaussian Mixture to fit a large scope of density in real life.

# density estimation for the MCMC (with Gaussian Mixtures)

density <- density_estimation(X = X_appr, nbclustmax = 10, detailed = TRUE, package = "Rmixmod")

Bic_null_vect <- density$BIC_vect # vector of the BIC found (1 value per covariate)Each null hypothesis is associated to a BIC criterion. Complexity is the one of each mixture model.

MCMC Algorithm

We use a specific MCMC algorithm (http://www.theses.fr/2015LIL10060 and http://www.theses.fr/2015LIL10060/document/ or https://hal.archives-ouvertes.fr/hal-01099133/) to find the Adjacency matrix that describes the correlation structure. We use the Bayesian Information Criterion (BIC) to compare null hypothesis and complex correlations structures with many sub-regressions between covariates.

# MCMC to find the structure

res <- structureFinder(X = X_appr, verbose = 0, reject = 0, Maxiter = 1500, nbini = 30,

candidates = -1, Bic_null_vect = Bic_null_vect, star = TRUE, p1max = 15, clean = TRUE)

hatZ <- res$Z_opt # found structure (adjacency matrix)

hatBic <- res$bic_opt # associated BICCorReg’s Power

As we work with a dataset we have generated, we know the true structure so we can compare the result with the true model. In terms of BIC:

# BIC comparison between true and found structure

bicopt_vect <- BicZ(X = X_appr, Z = hatZ, Bic_null_vect = Bic_null_vect)

bicopt_True <- BicZ(X = X_appr, Z = TrueZ, Bic_null_vect = Bic_null_vect)

sum(bicopt_vect)## [1] 260.0324

sum(bicopt_True)## [1] 260.2678And in terms of structure:

# Structure comparison

compZ <- compare_struct(trueZ = TrueZ, Zalgo = hatZ) # qualitative comparison

compZ## $ratio_true1

## [1] 1

##

## $ratio_true0

## [1] 0.9659091

##

## $true1

## [1] 12

##

## $false1

## [1] 3

##

## $false0

## [1] 0

##

## $deltadr

## [1] -1

##

## $true_left

## [1] 4

##

## $false_left

## [1] 1Then we have a look on the sub-regressions themselves. Each item of the list represents a subregression.

First element is the R-square.Second element is the variable that is regressed by others (if no names provided it gives the position of the variable in the dataset).

Then comes the list of the explicative variables in the subgression and the associated coefficients (in the first column). The readZ function allows to list them by relevance.

# interpretation of found and true structure ordered by increasing R2

readZ(Z = hatZ, crit = "R2", X = X_appr, output = "all", order = 1) # <NA>line : name of subregressed covariate## [[1]]

## coefs var

## 1 0.0128969901228426 R2

## 2 <NA> 4

## 3 -0.0125474630135259 intercept

## 4 -0.357743700517057 3

##

## [[2]]

## coefs var

## 1 0.864891002073106 R2

## 2 <NA> 10

## 3 0.771401375787121 intercept

## 4 -0.395158883860493 1

## 5 0.434417244927466 2

## 6 0.110371910953775 7

## 7 -0.201810912861014 9

##

## [[3]]

## coefs var

## 1 0.88371047637265 R2

## 2 <NA> 5

## 3 0.882458081337186 intercept

## 4 -0.184521085856526 1

## 5 0.355923752366177 2

## 6 0.0739571144269907 7

## 7 0.244314134164252 9

##

## [[4]]

## coefs var

## 1 0.916921053514203 R2

## 2 <NA> 8

## 3 -0.888385859472596 intercept

## 4 -0.278784074326651 2

## 5 0.426232950763516 3

## 6 -0.271458727006843 9

##

## [[5]]

## coefs var

## 1 0.96165616031404 R2

## 2 <NA> 6

## 3 -0.911123740892338 intercept

## 4 -0.139301488520349 3

## 5 0.158023419361921 7

## 6 0.158272657805682 9

readZ(Z = TrueZ, crit = "R2", X = X_appr, output = "all", order = 1) # <NA>line : name of subregressed covariate## [[1]]

## coefs var

## 1 0.853923472215609 R2

## 2 <NA> 10

## 3 0.828528829938383 intercept

## 4 -0.396912528013629 1

## 5 0.401032049394014 2

## 6 -0.141794851360059 9

##

## [[2]]

## coefs var

## 1 0.870092421108483 R2

## 2 <NA> 5

## 3 0.9207375822272 intercept

## 4 -0.185696153499888 1

## 5 0.333553271463032 2

## 6 0.284529209626182 9

##

## [[3]]

## coefs var

## 1 0.916921053514203 R2

## 2 <NA> 8

## 3 -0.888385859472596 intercept

## 4 -0.278784074326651 2

## 5 0.426232950763516 3

## 6 -0.271458727006843 9

##

## [[4]]

## coefs var

## 1 0.96165616031404 R2

## 2 <NA> 6

## 3 -0.911123740892338 intercept

## 4 -0.139301488520349 3

## 5 0.158023419361921 7

## 6 0.158272657805682 9We can finally use the correg function to make linear regression using the sub-regression structure learnt above. We get three models :

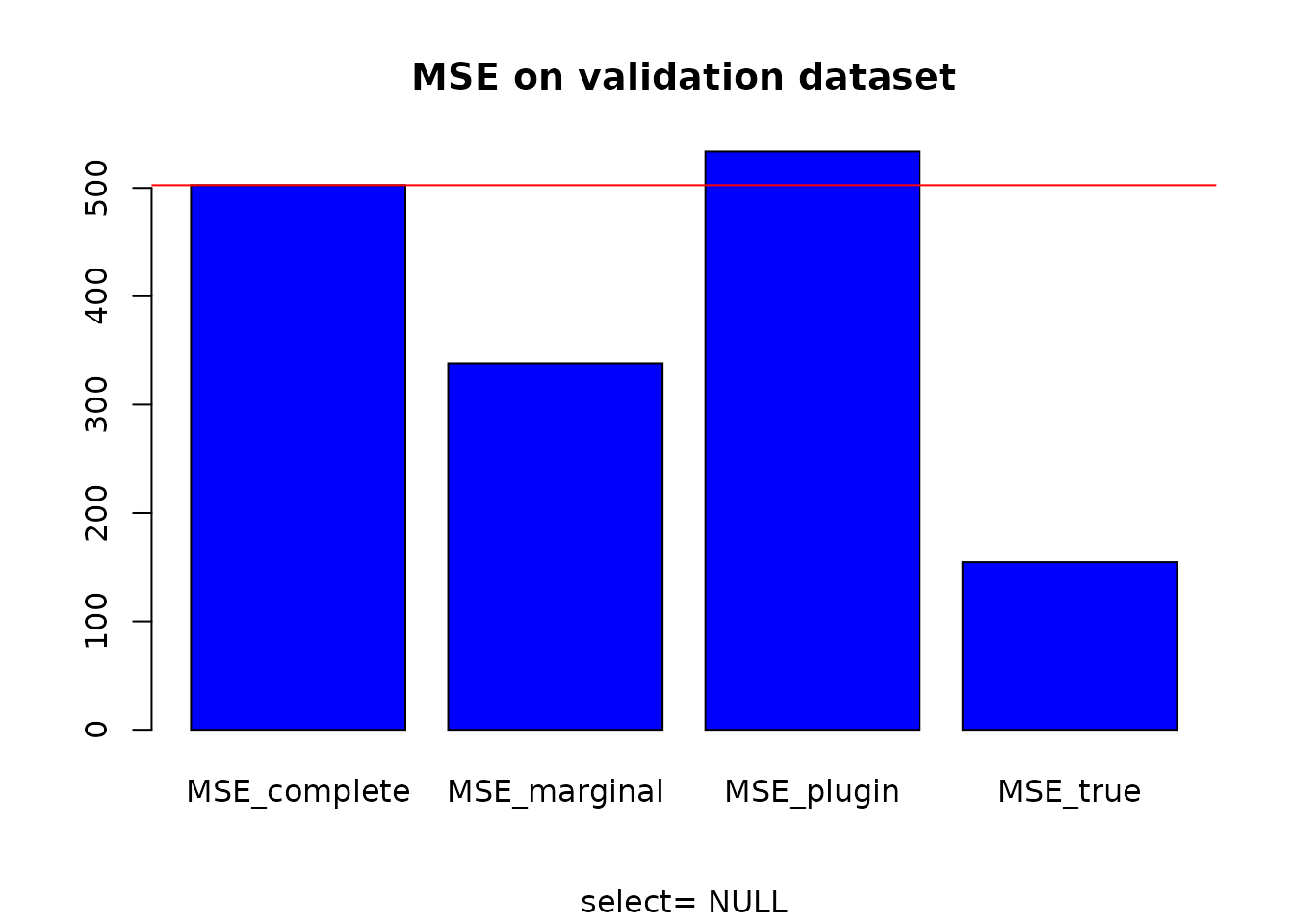

- Complete model : without the sub-regression structure

- Explicative model : with the redundant covariates pointed by the sub-regressions

- Predictive model : like the complete model but estimated sequentially to avoid correlation issues, by using the sub-regression structure.

# Regression coefficients estimation

select = "NULL" # without variable selection (otherwise, choose "lar" for example to use lasso selection)

resY <- correg(X = X_appr, Y = Y_appr, Z = hatZ, compl = TRUE, expl = TRUE, pred = TRUE,

select = select, K = 10)Final Predictive results comparison

# MSE computation

MSE_complete <- MSE_loc(Y = Y_test, X = X_test, A = resY$compl$A) # classical model on X

MSE_marginal <- MSE_loc(Y=Y_test, X = X_test, A = resY$expl$A) # reduced model without correlations

MSE_plugin <- MSE_loc(Y = Y_test, X = X_test, A = resY$pred$A) # plug-in model

MSE_true <- MSE_loc(Y = Y_test, X = X_test, A = base$A) # True modelThen we can compare the MSE obtained for each model.

# MSE comparison

MSE <- data.frame(MSE_complete, MSE_marginal, MSE_plugin, MSE_true)

MSE # estimated structure## MSE_complete MSE_marginal MSE_plugin MSE_true

## 1 502.5432 338.1377 533.5745 154.6208

barplot(as.matrix(MSE), main = "MSE on validation dataset", sub = paste("select=", select), col = "blue")

abline(h = MSE_complete, col = "red")